U.S. Real Estate and Multifamily Investment: Post-COVID Price Effects

- Jul 17, 2025

- 8 min read

Updated: Aug 12, 2025

Introduction

The COVID‑19 pandemic unleashed one of the most abrupt economic shocks in modern history, but it also triggered a set of forces that permanently reshaped the U.S. housing and multifamily investment landscape. Between March 2020 and today, the sector has raced through three distinct—and unusually compressed—cycles:

The Pandemic Boom (mid‑2020 → mid‑2022), when sub‑3 percent mortgage rates, unprecedented fiscal stimulus, and a surge in remote‑work–driven household formation pushed home and apartment prices to record highs;

The Rate‑Shock Correction (mid‑2022 → late‑2023), when the Federal Reserve’s fastest tightening campaign since the 1980s sent financing costs soaring, punctured demand, and repriced nearly every asset class—including residential and multifamily real estate; and

The Early‑Recovery Phase (2024 → present), characterized by tentative stabilization in borrowing costs, a slow thaw in transaction activity, and renewed—if cautious—interest from both individual and institutional buyers.

Understanding how prices moved through these phases, and how buyers responded, is critical for anyone planning to deploy capital in the next 12–24 months. Real estate now sits at the nexus of four macro dynamics: persistent housing undersupply, shifting household preferences, tighter credit conditions, and a policy environment that is simultaneously fighting inflation and confronting an affordability crisis. Each exerts a profound influence on where prices settle and on which types of investors are most active.

Why Focus on Prices?

Price is not just a number on a closing statement; it is the market’s real‑time scorecard of risk, return, and scarcity. For the individual homebuyer, higher prices translate directly into larger down payments and monthly obligations, often determining whether a purchase is feasible at all. For institutional investors—pension funds, REITs, private‑equity sponsors—price dictates cap rates, total return targets, and portfolio‑level allocations between property types and geographies. Over the past five years, even small swings in interest rates have produced double‑digit moves in asset values, amplifying both opportunity and peril.

Scope of This Report

This report zeroes in on the U.S. residential for‑sale and multifamily rental markets from the onset of the pandemic (Q1 2020) through mid‑2025. It dissects:

Post‑COVID price trajectories—how single‑family home prices and multifamily valuations rose, peaked, and partially retraced;

Behavioral shifts among buyers—how affordability pressures, work‑from‑home trends, and credit tightening altered the calculus for first‑time homeowners, small landlords, and large institutions;

Investment catalysts and headwinds—including the role of Fed policy, construction cost inflation, supply–demand imbalances, and demographic tailwinds; and

Forward‑looking scenarios—what reputable forecasts suggest about price growth, cap‑rate compression, and transaction volumes through 2026.

By synthesizing government data (FHFA, Census), lender research (Freddie Mac, Fannie Mae), brokerage surveys (CBRE, NAR), and institutional outlooks (PwC, Clarion Partners), we aim to provide a balanced, data‑rich narrative that helps investors calibrate strategy to the next cycle. Whether you are an individual contemplating a rental duplex or an allocator weighing a $500 million multifamily mandate, the pages that follow should clarify where the market has been, why participants behaved the way they did, and where pricing—and therefore opportunity—appears to be headed.

1. Price Trends Since the COVID-19 Pandemic

After 2020, U.S. home prices surged. Over 2021–22, extraordinarily low mortgage rates and strong demand drove median housing values to new highs (NAR data show the May 2025 median existing-home price at ~$423K). By mid-2024 prices were still rising but at a slower pace – FHFA reports Q3 2024 prices up +4.3% versus a year earlier. Analysts attribute the slowdown to housing costs and interest rates peaking. Most forecasters see only modest gains ahead: for example, NAR projects U.S. home prices will rise roughly 2% in 2025 as mortgage rates stabilize around 6% and more inventory slowly returns.

The multifamily market (apartment buildings) saw a similar boom-and-correction. Property values peaked in mid-2022 after roughly a 24% post-pandemic jump, then plunged. Fannie Mae reports that by mid-2024 multifamily values were down roughly 20–25% from the 2022 peak; Freddie Mac likewise notes values are ≈19% below late-2022 highs. Cap rates have risen about 1.9 percentage points on average (multifamily up ~1.95 pp) over that period, reflecting the yield adjustment needed as interest rates climbed. Sales activity collapsed: multifamily transaction volume fell from ~$384 billion in 2022 to about $120 billion in 2023. Despite recent weakness, fundamentals remain supportive. U.S. housing shortages persist – Clarion Partners estimates a national deficit of roughly 2.8 million units (about 1.5M of which are rental) – and strong demographics keep demand high. As a result, experts expect that once interest rates ease and the supply wave abates, rents and multifamily values will stabilize and begin climbing again.

2. Impact on Buyer Behavior and Confidence

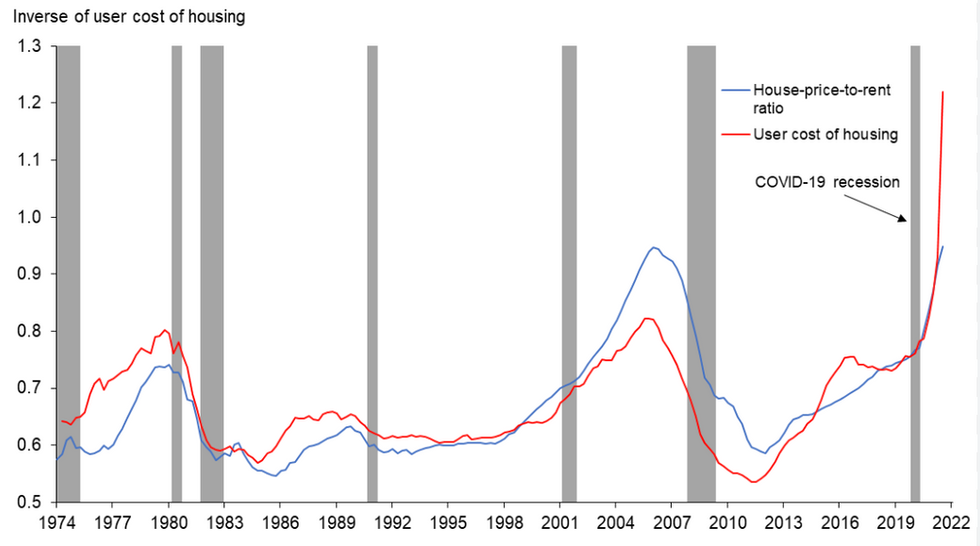

Skyrocketing prices and mortgage costs have strained many buyers. Homeownership affordability fell to historic lows as prices doubled over the past decade and 30-year rates briefly approached 7%. Many existing owners are “locked in” on low-rate mortgages and reluctant to sell, reducing available inventory. Freddie Mac observes that first-time buyers now make up a record share of the market: over 50% of Freddie Mac–backed purchase loans by mid-2024 went to first-timers, even as repeat buyer activity cooled. The result is a bifurcated market: higher-end and newer-housing segments remain hot, while entry-level buyers face the steepest affordability squeeze. In the rental sector, expensive homeownership has actually propped up demand: one analysis found that higher house prices and mortgage rates have made buying “far more expensive than renting,” keeping would-be homeowners in the renter pool longer. All told, consumer confidence toward buying a home dipped through 2022–23, with many potential buyers holding back or downgrading their search. NAR’s economists note that lower mortgage rates would “attract more buyers and sellers…increasing mobility,” implying that recent rate declines (from 7% to ~6%) have begun to restore confidence.

At the same time, investor demand remained unusually high. “Investor buyers” (landlords and speculators) accounted for a much larger share of home purchases than before COVID. Realtor data show that investors bought 8–9% of U.S. homes sold through early 2022 – roughly double the pre-pandemic level. Even as overall sales softened, investor sales held up better: in 2022 investor home purchases actually grew +6.4% from 2021 while non-investor sales fell 16.6%. This indicates investors (especially cash-rich ones) were willing to pay up during the 2021–22 boom. By late 2022 and into 2023, however, their activity eased. Investor market share dipped from its Feb. 2022 peak of 8.9% down to ~8.2% by Dec. 2022. All-cash purchases by investors also declined (from ~74% in late 2021 to ~67% by Dec. 2022) as competition eased. In summary, high prices and rates dampened broad buyer confidence, boosting demand for rentals and keeping new owner-move-ups muted, while investors temporarily took up some slack (albeit later retreating).

3. Individual vs. Institutional Investors

Individual (Small) Buyers: Many “mom-and-pop” buyers and small investors were active during the boom, often buying with mortgages. As market competition peaked in 2021, smaller investors tended to win bids financed by debt, especially when larger firms paid cash. By late 2022, the tables turned: Realtor reports that the share of investor purchases made by “large” investors (those buying >50 homes) fell sharply, from ~32% in mid-2022 to a lower level by year-end, while the share by smaller investors (≤10 homes) rose realtor. This suggests that as yields declined, big cash players pulled back and smaller buyers (who usually finance deals) were able to re-enter. In raw numbers, although investor involvement is up from pre-COVID levels, institutions still own only a small fraction of single-family housing. For example, by late 2022 the two largest single-family rental investors together owned only ≈3% of all SFR homes.

Institutional Buyers: Large institutions and funds dominated the multifamily sector before and after COVID. Commercial real estate surveys show multifamily remains the most-preferred sector: in 2024 about 42% of global CRE investors targeted apartments, up from 30% in 2023. Still, institutions have become more risk-averse. In CBRE’s 2024 investor survey, over 80% of multifamily buyers cited high interest rates and tight credit as concerns. Many are shifting toward core/core-plus strategies (up to 33% vs 27% in 2023) and reducing high-risk (opportunistic) exposure. Reflecting this caution, institutional multifamily cap rates have likely peaked and are expected to compress as rates fall. Overall, professional real estate investors express cautious optimism: a majority expect to ramp up apartment acquisitions in the coming year, and nearly all surveyed believe the sector will be in recovery by mid-2025. In contrast, individual small-scale participation in the multifamily market is minimal (most small landlords target single-family or condo investments), so the institutional sentiment largely sets the tone for apartments.

4. Catalysts for Renewed Investment

Several factors are drawing buyers back into real estate. Falling borrowing costs are key: after peaking, long-term mortgage and cap rates have begun to retreat in late 2024. Industry analyses note that expected Fed rate cuts should “spark an increase in deal activity”. Indeed, multifamily mortgage originations jumped ~57% year-over-year in Q3 2024 as loan demand recovered. For homebuyers, each percentage-point drop in rates meaningfully lowers required income to qualify (NAR calculates that a move from 7% to 6% 30-year rates brings ~6.2M more households into reach of a median-priced home). Unmet demand and shortages also lure buyers. Households—especially younger cohorts—still want homes, but inventory is tight: new construction (though higher than pre-pandemic) has lagged needed levels, and many homeowners delay selling. Clarion Partners cites a national shortfall of ~2.8M housing units; in rental housing alone the gap is ~1.5M units. This scarcity supports property values and entices investors who expect fundamentals to prevail. Finally, valuation discounts after 2022 have made deals more attractive. Multifamily buildings can be bought yielding ~5–6% cap rates (vs ~3% in 2021), so risk-adjusted returns are higher, motivating opportunistic buyers. The convergence of slightly lower rates, still-solid demand, and attractive entry valuations has coaxed both individuals and institutions to reinvest in real estate and apartments by late 2024.

Multifamily development surged after the pandemic, especially in Sunbelt metros. U.S. apartment starts hit about 614K annualized units in April 2022 before slowing to ~326K by Oct. 2024. This boom in new supply briefly eased rent growth, but occupancy remained high. As pipeline completions taper off, analysts expect rents and values to pick up again in coming years.

5. Outlook: Future Pricing, Demand, and Sentiment

Looking ahead, the consensus is for a gradual stabilization. In the for-sale market, forecasts see prices rising modestly as rates normalize. NAR, for example, predicts only ~2% home price growth in 2025. If mortgage costs do stabilize around 6%, more buyers are expected to re-enter, which should boost sales volumes from the low 2023 levels. However, inventory is likely to remain lean relative to demand, so affordability will still be a concern in hot markets. Freddie Mac, for instance, expects home sales to pick up modestly in 2025 and prices to continue rising on the persistent supply–demand imbalance.

In the multifamily arena, most forecasts also call for a recovery by mid-decade. Many experts believe cap rates have peaked and will drift lower as borrowing costs fall. Rent growth is forecast to resume once new deliveries wane; Freddie Mac expects positive but below-average rent gains in the near term. Importantly, long-term fundamentals remain strong. Institutions emphasize that housing remains desperately needed – e.g. rental housing demand outstrips the new supply wave – and demographic trends (millennials forming households, etc.) support higher occupancy and rent over time. A broad industry outlook (PwC/ULI’s Emerging Trends) similarly notes that as pandemic disruptions fade, “positive cyclical forces” – particularly rising demand and easing costs – should emerge.

Investor sentiment reflects this cautious optimism. Surveys show the majority of multifamily investors intend to buy more once conditions allow, with the vast majority anticipating a rebound in values by late 2024/early 2025. In summary, while the market still faces headwinds (high debt costs, affordability limits, regulatory scrutiny), most analysts expect 2025 to bring stabilized pricing, gradual inventory relief, and improving confidence. Underlying housing shortages and demographic demand should prevent any broad price collapse, so prices and rental rates are generally expected to trend modestly upward on balance.

Conclusion

Five years on, COVID’s most lasting legacy is not empty office towers or endless Zoom calls—it is a national housing market where structural under‑supply collides with interest‑rate volatility. Prices galloped, swooned, and are now re‑balancing at levels that still look expensive to consumers but increasingly attractive to capital relative to other asset classes. Individual buyers face a thinner affordability margin yet remain motivated by life‑cycle needs; institutional buyers, armed with dry powder and longer duration capital, are positioning for the next leg up in valuations. In that tug‑of‑war, pricing will again set the pace: if rates plateau or fall, expect a measured but broad‑based rebound in both single‑family and multifamily investment over the next 12‑24 months.

Sources: Data and forecasts are drawn from

Freddie Mac and Fannie Mae housing reports,

government statistics (FHFA House Price Index)

Census housing data

investor surveys (Realtor, CBRE/Origin)

industry analyses (Clarion Partners, Arbor/MBIA, PwC)

Comments